Low cost, non-exam life insurance for any pre-existing condition!!!

404.233.FLIG

Are They Final Expense Clients?

Are They Final Expense Clients?

The two objectives for this white paper are to provide life insurance agents with additional insights

into potential final expense clients and how to identify them.

The Market

Does the picture of the couple above suggest your typical final expense prospect? Probably not, if we define final expense as small policies between $10,000 and $25,000 for lower income clientele primarily used for burial expenses. Suppose we ask a different question. Will they have final expenses? Of course, we will all have final expenses and should have a plan to deal with them. Our assumption is that this couple will not benefit much from a typical final expense policy, or that they have savings to cover burial cost. But final expenses can be much more than just funeral arrangements. Credit cards, mortgages, auto loans and local estate or inheritance taxes are other potential expenses. Some are interested in leaving a financial legacy for their children and grandchildren. The death benefit of a life insurance policy is not subject to the probate process if it is paid to a named beneficiary instead of your estate, so it can provide funds to your beneficiaries more privately and generally faster than other assets in your estate. The income of a surviving spouse may be significantly reduced or even eliminated upon the death of their partner. Life insurance can help bridge that income gap. So yes, we can define this couple as final expense prospects.

The concept remains the same. There will be a need for money upon the demise of the individual. What changes are the product line, face amount and premium. Certainly, a policy face amount greater than $10,000 is necessary to cover any of the above mentioned potential final expenses, other than burial. The age of this final expense market is the same, 50 to 75, but their income is defined as middle to upper middle income. As a result their needs are greater, producing higher premiums than the traditional final expense market.

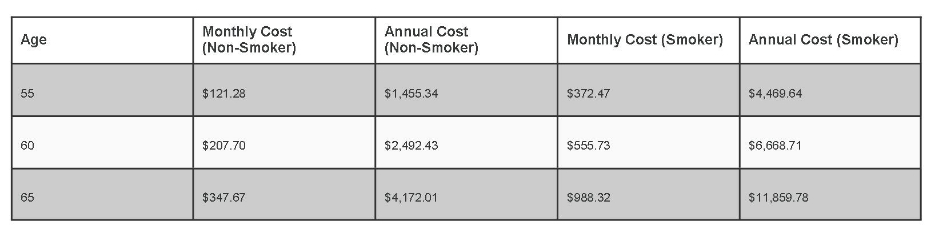

Average cost for $250,000 of 20 year term

Finding This FE Market

It comes as no surprise to agents that a higher income final expense market exist. The question is how to access them without losing focus on your core market. One of the easiest ways is by purchasing internet leads from established lead providers. Because of their shared nature, internet leads are often inexpensive: $5 to $11 per lead. Your lead order can be filtered by age, desired face amount and health or any combination of these depending on the lead provider. As an example, your age range may be 50-75, and a desired face amount of $100,000 or less. You’ll speak to those that sought $50,000, $75,000 or $100,000 of coverage, typically in term. A person requesting these face amounts will be considering the other final expenses noted above. Although term is more suited for income replacement than final expense, many of these leads will insist on term because it’s much cheaper than whole life.

Products

This clientele is well suited for simplified issue products because of health constraints that are prevalent in this age range. Issues such as high blood pressure, cholesterol , diabetes and obesity fit well into simplified issue products. These issues will not allow them to qualify for preferred rates with fully underwritten plans. Many final expense carriers focus on simplified issue products to include term, traditional whole life and universal life. You may already be contracted with some of them and selling only their final expense product.

Some carriers offer traditional whole life products with term riders that provide additional coverage for a specified number of years, 10 or 20. After the term rider expires the whole life coverage remains in place until death.

It is important for the final expense specialist to understand their client’s health, finances and desires to ensure the right product fit. Having a client that had a stroke 4 years ago apply for a traditional non final expense product is a likely decline and misapplication of the product.

Agent Development

Employing this strategy may require some growth and development on the part of the agent to extend their final expense sales to include a higher income client. The agent must learn to work between the groups of people with the same basic need, final expense. The agent must be able to offer a wider range of products to meet the variation of coverage needs desired by both groups. Mixing these sales will result in higher overall average premiums with higher average persistency.

The two objectives for this white paper are to provide life insurance agents with additional insights

into potential final expense clients and how to identify them.

The Market

Does the picture of the couple above suggest your typical final expense prospect? Probably not, if we define final expense as small policies between $10,000 and $25,000 for lower income clientele primarily used for burial expenses. Suppose we ask a different question. Will they have final expenses? Of course, we will all have final expenses and should have a plan to deal with them. Our assumption is that this couple will not benefit much from a typical final expense policy, or that they have savings to cover burial cost. But final expenses can be much more than just funeral arrangements. Credit cards, mortgages, auto loans and local estate or inheritance taxes are other potential expenses. Some are interested in leaving a financial legacy for their children and grandchildren. The death benefit of a life insurance policy is not subject to the probate process if it is paid to a named beneficiary instead of your estate, so it can provide funds to your beneficiaries more privately and generally faster than other assets in your estate. The income of a surviving spouse may be significantly reduced or even eliminated upon the death of their partner. Life insurance can help bridge that income gap. So yes, we can define this couple as final expense prospects.

The concept remains the same. There will be a need for money upon the demise of the individual. What changes are the product line, face amount and premium. Certainly, a policy face amount greater than $10,000 is necessary to cover any of the above mentioned potential final expenses, other than burial. The age of this final expense market is the same, 50 to 75, but their income is defined as middle to upper middle income. As a result their needs are greater, producing higher premiums than the traditional final expense market.

Average cost for $250,000 of 20 year term

Finding This FE Market

It comes as no surprise to agents that a higher income final expense market exist. The question is how to access them without losing focus on your core market. One of the easiest ways is by purchasing internet leads from established lead providers. Because of their shared nature, internet leads are often inexpensive: $5 to $11 per lead. Your lead order can be filtered by age, desired face amount and health or any combination of these depending on the lead provider. As an example, your age range may be 50-75, and a desired face amount of $100,000 or less. You’ll speak to those that sought $50,000, $75,000 or $100,000 of coverage, typically in term. A person requesting these face amounts will be considering the other final expenses noted above. Although term is more suited for income replacement than final expense, many of these leads will insist on term because it’s much cheaper than whole life.

Products

This clientele is well suited for simplified issue products because of health constraints that are prevalent in this age range. Issues such as high blood pressure, cholesterol , diabetes and obesity fit well into simplified issue products. These issues will not allow them to qualify for preferred rates with fully underwritten plans. Many final expense carriers focus on simplified issue products to include term, traditional whole life and universal life. You may already be contracted with some of them and selling only their final expense product.

Some carriers offer traditional whole life products with term riders that provide additional coverage for a specified number of years, 10 or 20. After the term rider expires the whole life coverage remains in place until death.

It is important for the final expense specialist to understand their client’s health, finances and desires to ensure the right product fit. Having a client that had a stroke 4 years ago apply for a traditional non final expense product is a likely decline and misapplication of the product.

Agent Development

Employing this strategy may require some growth and development on the part of the agent to extend their final expense sales to include a higher income client. The agent must learn to work between the groups of people with the same basic need, final expense. The agent must be able to offer a wider range of products to meet the variation of coverage needs desired by both groups. Mixing these sales will result in higher overall average premiums with higher average persistency.

Rate this article

TM

(C) 2014 Family Life Insurance Group, LLC

TM

FOLLOW US

PHONE

FIND US

404.233.FLIG (3544)

LIFE INSURANCE QUOTE

MEDICARE QUOTE

CRITICAL ILLNESS QUOTE

MEDICARE QUOTE

CRITICAL ILLNESS QUOTE

Affordable Life Insurance

Critical Illness

Medicare

Retirement Planning